From the lenders point of view factoring is preferable to an overdraft because it is secured against assets the sales invoices and therefore carries less risk. Free up cash flow for your company.

Guide To Invoice Factoring For Small Businesses Bluevine

You sell your unpaid invoices to a factoring company in exchange for money up-front.

. The risk size of the. Commonly used for high risk. The bank can ask for the money back any.

Factoring vs Overdraft Facility. In most cases the factoring company will give you. Ad Funding Americas fastest growing businesses for 20 years.

Tell us a bit about your business and well provide you with a free personalized estimate. Turn your open invoices into cash. Founded in 2013 BlueVine is one of the best invoice factoring companies on the market.

To illustrate simply a 1 weekly factoring fee on a 100000 invoice means that the factor will charge 1000 every week the invoice remains unpaid. Invoices paid in hours. Find the providers that will give you the best rates and terms such as avoiding personal guarantees.

Ad Read reviews on the premier Invoice Tools in the industry. Countless online reviews applaud the simple application process the 24-hour. Dont Wait to Get Paid.

Invoice your customer advance funds get paid. Debtor finance facilities on the other hand can provide financing only up to the amount of the sales. Invoice Factoring and Overdraft Facilities Compared.

If any business is in need of financing the best option is invoice financing as it offers a number of businesses a simpler option for acquiring the said funds. The ability of banks to lend on overdraft facilities has been reduced due to certain test cases in the. A Debt Free Finance Alternative.

Ad Get the cash you need today without taking on debt. Ad Compare Top Invoice Factoring Companies Lowest Online Rates Reliable Reviews. Get customized funding that fits your business needs.

Overdrafts are suitable for established businesses with excellent credit scores and trading history. Factoring is a suitable alternative to an overdraft facility. Ad Truckers Get The Fastest Funding Possible with Apex Factoring.

GetApp helps more than 18 million businesses find the best software for their needs. Have Great Cash Flow and A Great Balance Sheet. Speak to an industry specialist now.

Ad Use your receivables to finance your business expenses. Invoice finance is better for startups or businesses with bad credit but an overdraft is more well-suited to business-to-consumer B2C companies. Tell us a bit about your business and well provide you with a free personalized estimate.

Apex Full-Service Factoring Helps Truckers Keep Moving. Discuss your requirements now. Ad Apply within 3 minutes online.

Find out how much cash flow you could quickly release. Overdraft facilities allow you to withdraw and use as much money as your limit allows. Invoice factoring on the other hand is an attractive option for any business.

Sales invoice factoring and bank overdraft facilities both provide flexible financing for businesses. Invoice factoring is a relatively simple concept. Comparing online saves you time.

Turn your open invoices into cash. Ad Get the cash you need today without taking on debt. In the majority of cases overdraft lending is cheaper than invoice finance on a like-for-like basis.

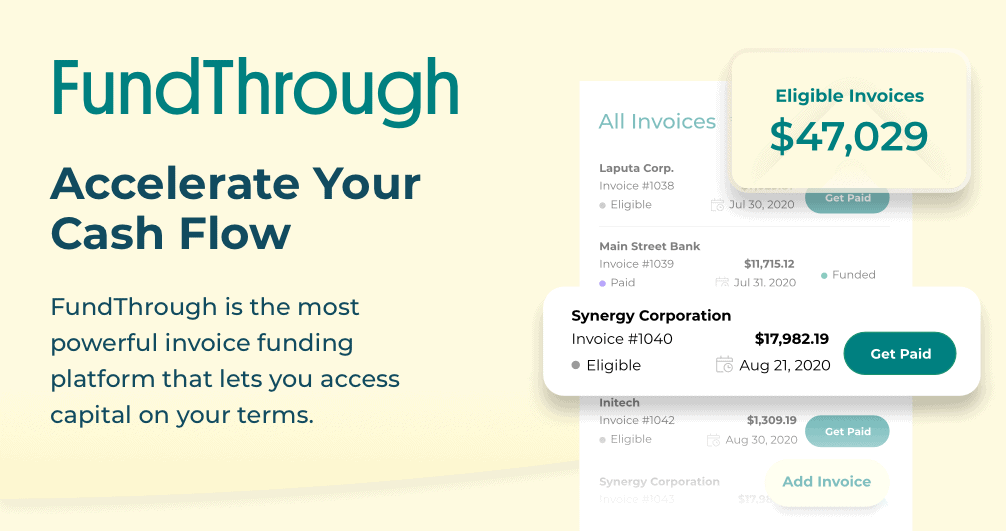

Invoice Factoring Guide Invoice Factoring Basics And How Invoice Factoring Works For Small Business Fundthrough

The Pros And Cons Of Invoice Factoring For Business Owners Ff Blog

The Pros And Cons Of Invoice Factoring For Business Owners Ff Blog

0 Comments